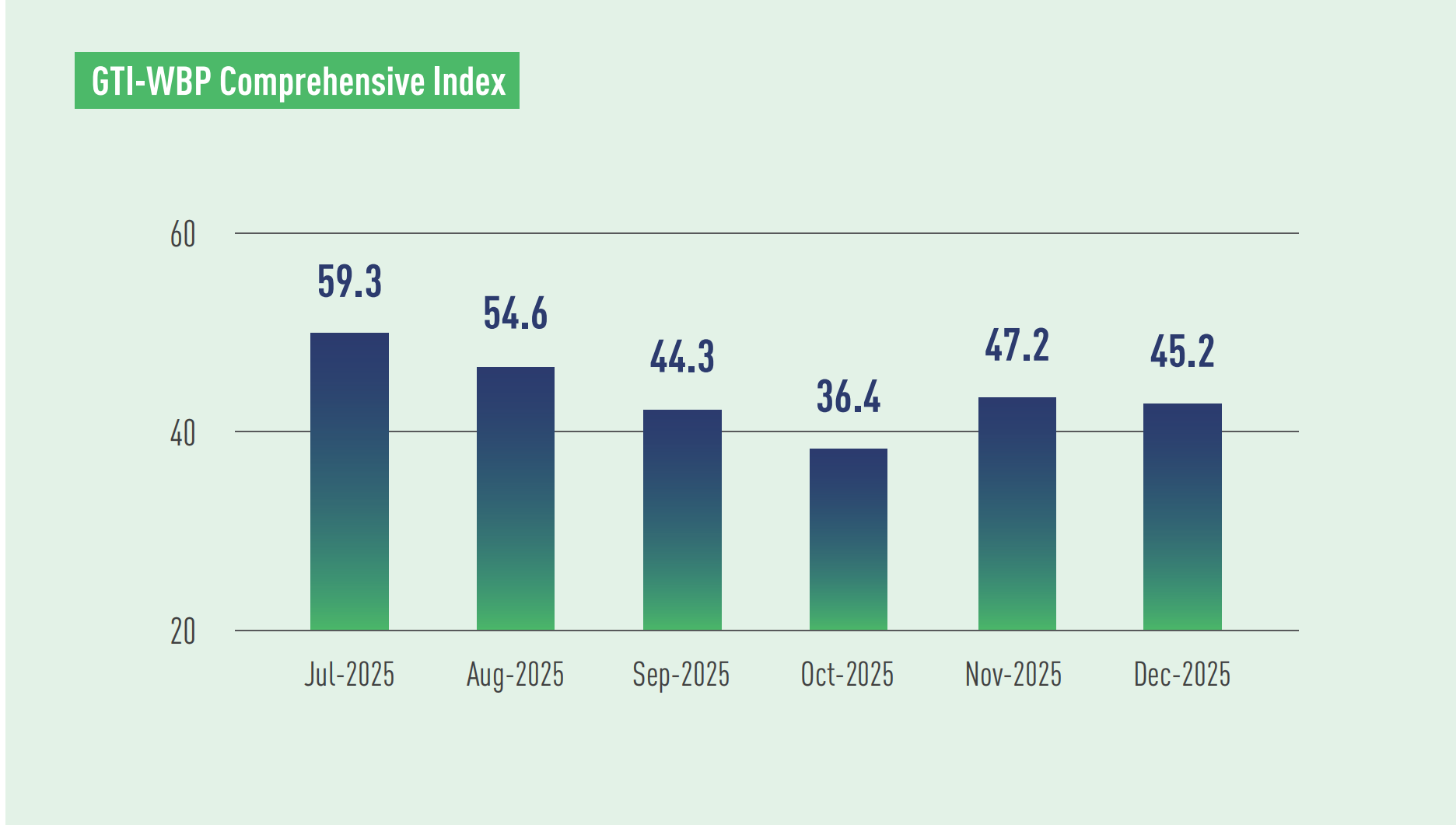

In December 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 45.2%, a decrease of 2.0 percentage points from the previous month and below the critical value (50%) for four continuous months, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index shrank from the previous month.

On the demand side: Overall demand for wood-based panels continued to decline in the GTI-WBP pilot countries. This month, the new orders index stood at 44.1%, the export orders index at 40.6%, and the existing orders index at 43.4%, all in the contraction territory below the 50% critical value. One reason for the decline in demand is that the timber markets of several pilot countries were in the off-season at the end of the year. During the period, construction and renovation activities slowed down and the overall end-consumer demand was sluggish, which directly dampened purchasing interest for wood-based panels.

On the supply side: The production index for wood-based panels stood at 44.7%, marking the fourth consecutive month below the 50% critical value and signaling an overall contraction in production capacity. Amid weak market conditions, constrained raw material supply and even rising input costs, some WBP manufacturers had proactively scaled back production. Meanwhile, the inventory index of finished products reached 54.4%, reflecting soft demand and sluggish inventory turnover, which led to a month-on-month rise in stock levels.

From a price perspective: The purchase price index for raw materials recorded 62.5%, remaining above the 50% critical value for the 18th consecutive month, signaling a prolonged upward trend in material costs. At the same time, enterprises were facing cost pressures from labor, utilities, transportation, and taxes, creating a broad-based cost burden. In this environment, strengthening cost control had become an urgent priority for WBP manufacturers.

Main updates related to the wood-based panel market include: In 2025, the production capacity expansion for particleboard slowed down in China. According to partial industry data tracking production lines with annual capacity exceeding 200,000 m³, China added approximately 5.05 million m³ of new particleboard capacity in 2025 — a slower pace of growth compared with 2024. In other news, on December 15, Hugh Brown, Chief Executive of Ghana’s Forestry Commission, revealed during a year-end media briefing that as of the end of October 2025, a total of 108,937 cubic meters of plywood valued at GHS 640 million had been traded in Ghana’s domestic market.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|