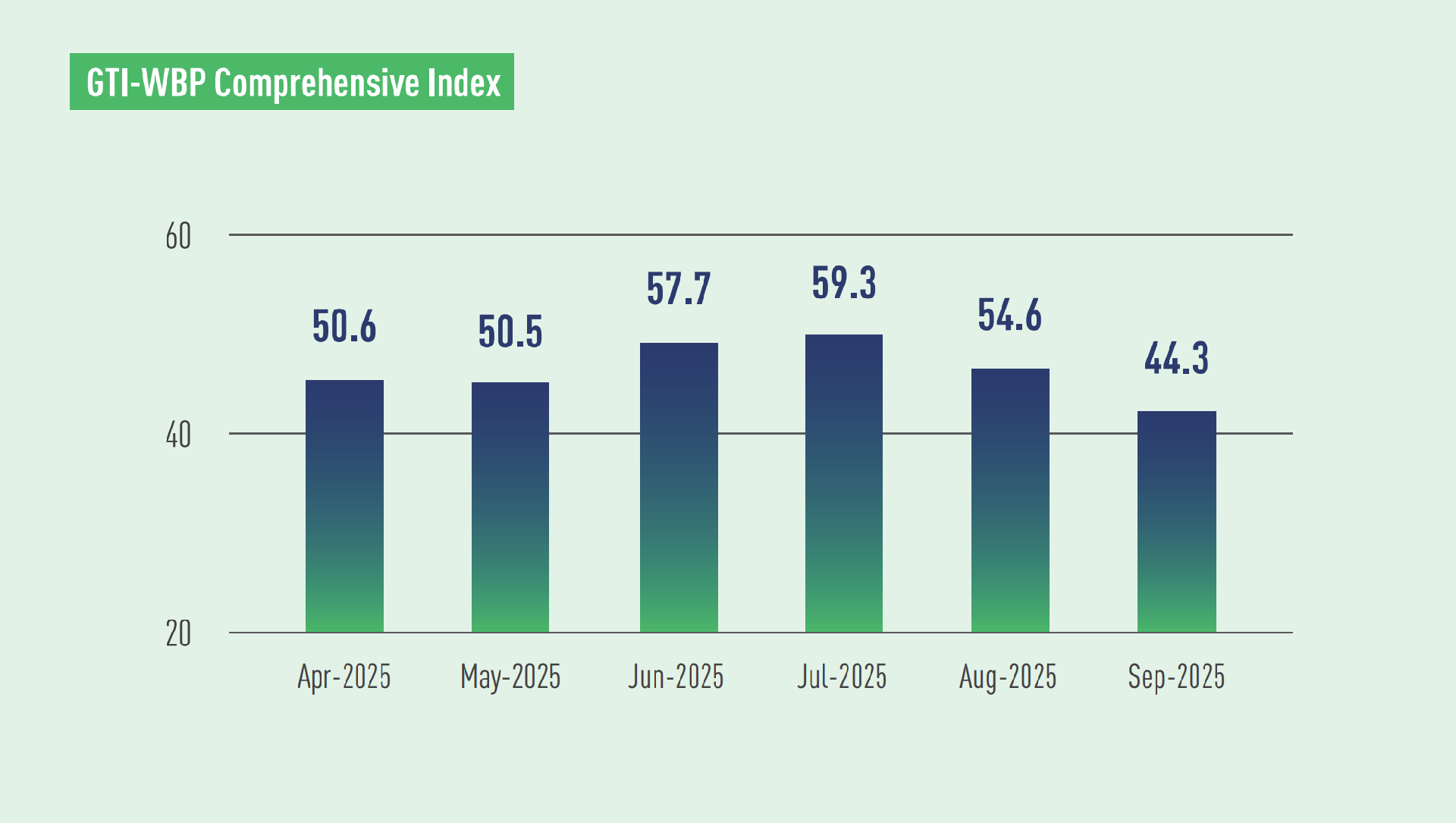

In September 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 44.3%, a decrease of 10.3 percentage points from the previous month and below the critical value (50%) again after five months, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index had shifted from expansion to contraction.

On the demand side, the overall demand for wood-based panels in the GTI-WBP pilot countries began to decline, suggesting that the short-term growth observed over the previous three months may have reached a temporary peak. This month, all the indexes related to wood-based panel demand dropped below the 50% critical value. Specifically, the new orders index registered 47.6%, a decrease of 5.6 percentage points; the export orders index stood at 44.8%, down 8.1 percentage points; and the existing orders index was at 42.9%, dropping 7.9 percentage points. A detailed breakdown indicates that the decline in new orders was mainly from the international market. As the wave of advance ordering spurred by U.S. tariff policies came to an end, the volume of orders in the international wood-based panel market had begun to decline. By product category, global market conditions for plywood products were still unstable and tends to be sluggish.

On the supply side, the supply of wood-based panels in the pilot countries declined, ending its six-month upward trend. The production index was at 41.7%, a decrease of 26.2 percentage points from the previous month, indicating an overall slowdown in production across the pilot countries. Meanwhile, the inventory index of finished products stood at 52.4%, remaining in expansion territory for the fifth consecutive month and signaling persistent risk of overcapacity in the wood-based panel industry. In this context, manufacturers need to, on one hand, control their production capacity, and on the other hand, drive product innovation in terms of sustainability, performance, and customization to break free from the fierce homogeneous competition.

In terms of prices, the purchase price index for raw materials recorded 58.2%, remaining above the critical value for the 15th consecutive month, indicating that amid continuous rises in the prices of logs and other production materials, the WBP manufacturers were facing significant cost pressures. Statistical data shows that for several consecutive months, the purchase prices of main raw materials had been rising in countries such as Ghana, Brazil, and Mexico, where enterprises voiced strong demands for cost reduction and efficiency improvement. In countries like Gabon, the cost pressure on raw material procurement had been continuously easing. However, enterprises still faced financial strains stemming from rising logistics costs and tariffs. Meanwhile, the low market prices of their products had also added to their financial burdens.

Main updates related to the wood-based panel market include: In August 2025, Brazil's tropical plywood exports jumped 87.0% in volume and 67.0% in value, from 1,500 m3 and US$0.9 million in August 2024 to 2,800 m3 and US$1.5 million. In the first half of 2025, Ecuador's exports of particleboard / MDP totaled US$91.3 million, marking a decline of 8.1% compared to the same period in 2024. Nevertheless, its key particleboard markets such as Peru, Mexico, and the United States still showed growth.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|