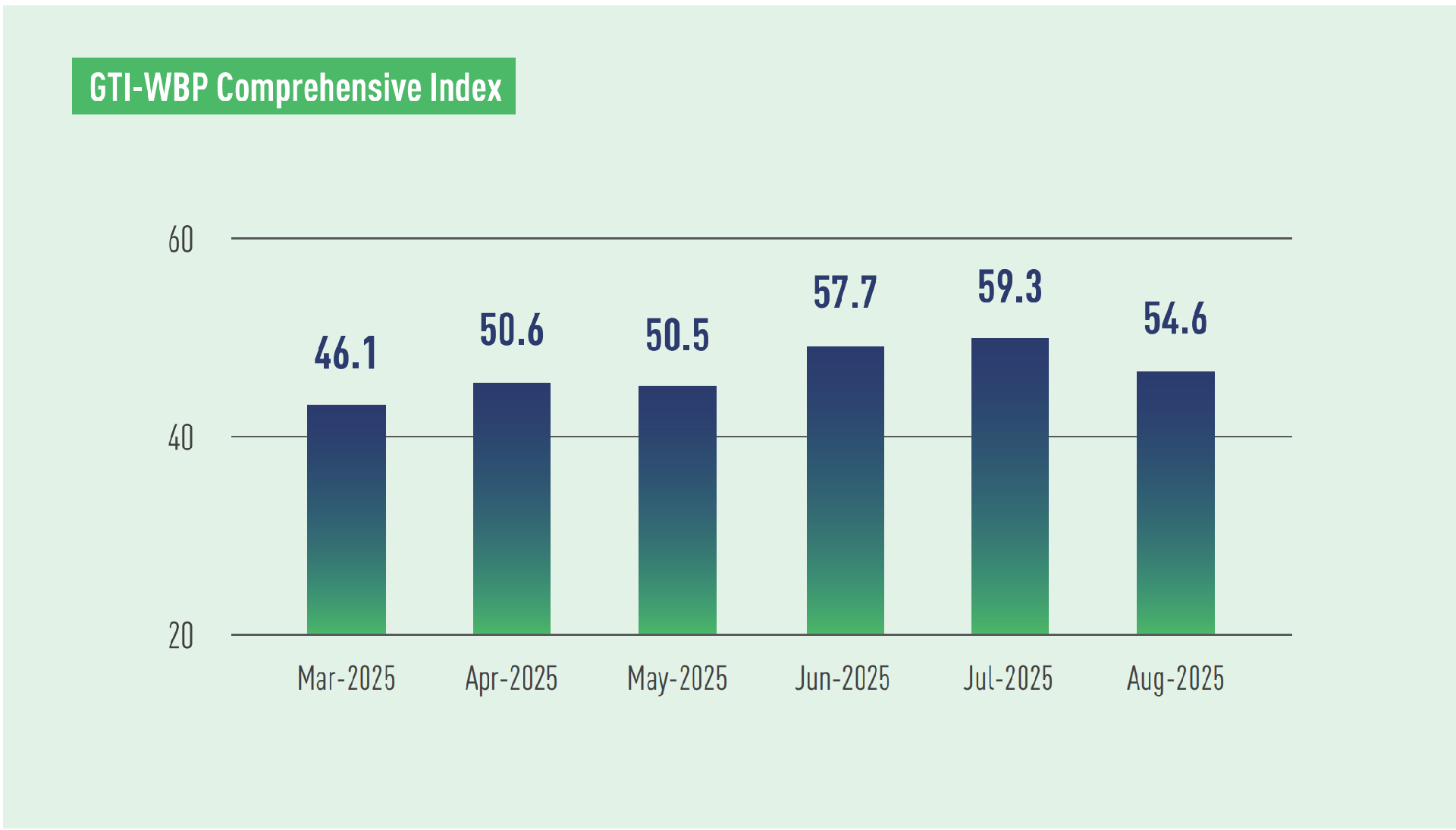

In August 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 54.6%, a decrease of 4.7 percentage points from the previous month and above the critical value (50%) for the fifth consecutive month, indicating that in the pilot countries, the overall business prosperity of wood-based panel industry represented by the index expanded from the previous month, however, the improvement was not so obvious as the previous month.

On the demand side, the overall demand for wood-based panels in the GTI-WBP pilot countries grew for the third consecutive month. This month, the new orders index registered 53.2%, the export orders index rose by 0.1 percentage point to 52.9%, and the existing orders index stood at 50.8%, indicating slight growth in both domestic and international demand for wood-based panels, as well as in the volume of existing orders. The three-month consecutive rise in overall demand for wood-based panels from June to August could be attributed to several factors, e.g., orders placed in advance as a result of U.S. tariff policies, accelerated subsidies for old home renovations in China, and increased demand driven by infrastructure expansion and post-disaster reconstruction in some countries.

On the supply side, the supply of wood-based panels in the pilot countries showed an upward trend for the sixth consecutive month. The production index registered 67.9%, up 4.7 percentage points from the previous month. Driven by the recovery in demand, the industry had accelerated capacity release in production. In addition, the inventory index of finished products stood at 56.5%, remaining in the expansion territory for the fourth consecutive month, indicating that amid temporary recovery in demand, the WBP manufacturers should be alert to potential overcapacity risks.

In terms of prices, the purchase price index for raw materials recorded 60.0%, remaining above the critical value for the 14th consecutive month, indicating that amid insufficient log supply in many countries, the WBP manufacturers were facing increasing cost pressures. Additionally, some sample enterprises reported financial strains due to rising labor, fuel, logistics and tariff expenses as well as delayed customer payments, so there is an urgent need to reduce costs, improve efficiency, and get tax relief or government subsidies.

Main updates related to the wood-based panel market include: Figures from the Department of Industrial Works (DIW) of Thailand covering January to July 2025 revealed that its domestic companies in wood processing and wood products industries were facing significant competitive pressure, particularly in segments such as particle board manufacturing. GTI-Brazil Focal Point reported that in the plywood segment, while Brazil maintains a solid global position, products face both U.S. tariffs and anti-dumping investigations in the European Union. And at the same time, international demand is driving greater appreciation for its eucalyptus plywood.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|