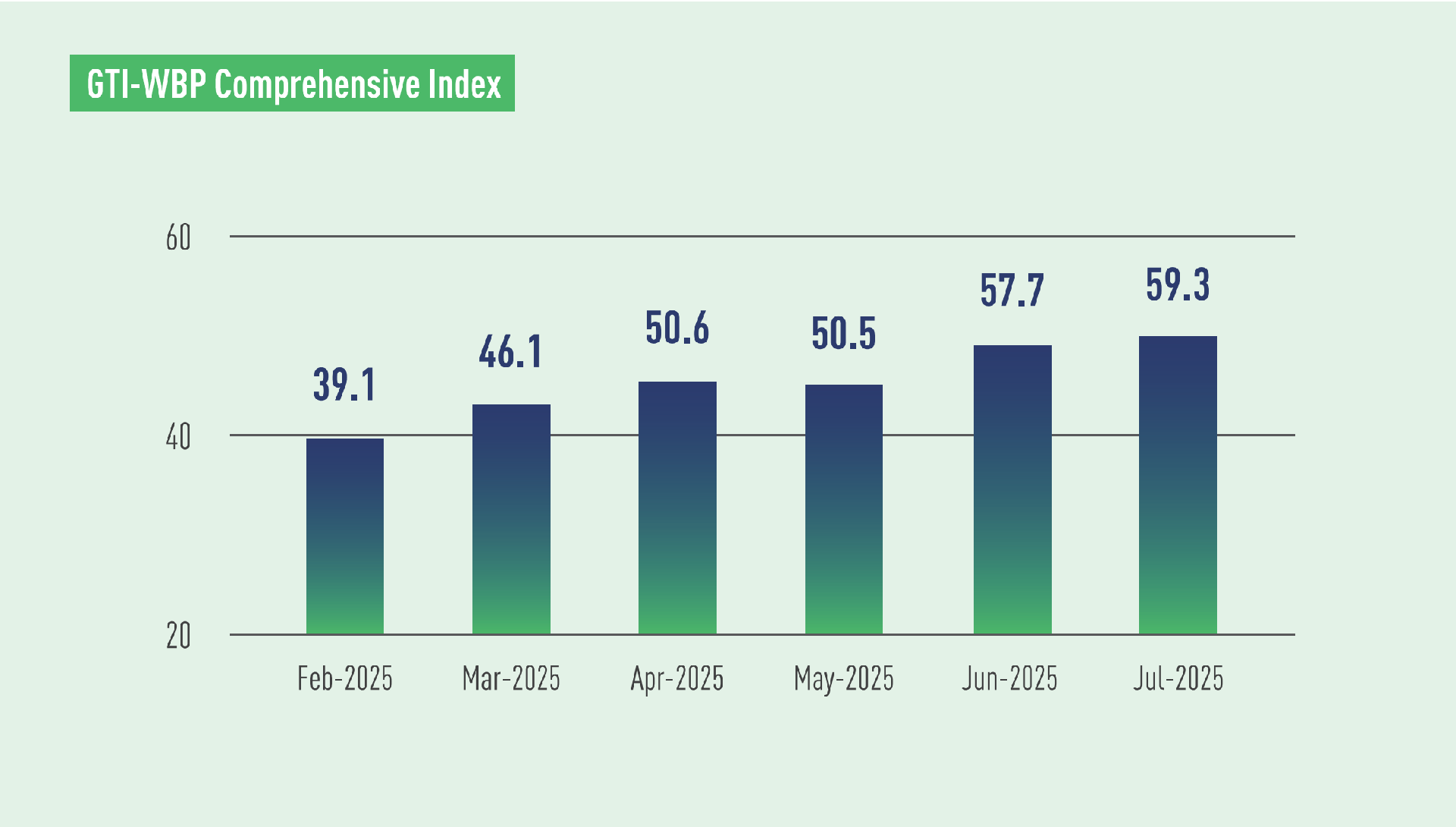

In July 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 59.3%, an increase of 1.6 percentage points from the previous month and above the critical value (50%) for the fourth consecutive month, indicating that in the GTI pilot countries, the overall business prosperity of wood-based panel industry represented by the index expanded from the previous month.

On the demand side, the overall demand for wood-based panels continued to grow in the GTI-WBP pilot countries, with all demand-related sub-indexes above the 50% critical value. This month, the new orders index rose by 6.8 percentage points to 62.7%, the export orders index fell by 1.7 percentage points to 52.8%, suggesting that market demand (domestic demand in particular) grew compared to the previous month. In addition, the existing orders index fell by 3.4 percentage points to 51.5% (still above the critical value), indicating that the total volume of orders on hand increased slightly, though the degree of growth was smaller than that of the previous month. It is worth noting that the international market demand for wood-based panels had remained in the expansion territory for four consecutive months, one contributing factor of which is that, fearing U.S. tariff policies will push up product prices, some clients of WBP enterprises had begun stockpiling large quantities of goods in advance.

On the supply side, the supply of wood-based panels in the pilot countries showed an upward trend for the fifth consecutive month. The production index registered 63.2%, up 2.1 percentage points from the previous month. With relatively strong demand in the international WBP market, enterprises had accelerated capacity release, keeping operating rates at a high level. In addtion, the inventory index of finished products stood at 59%, remaining in the expansion territory for the third consecutive month, indicating that WBP manufacturers should remain alert to potential overcapacity risks and strengthen demand-side analysis and forecasting.

In terms of prices, the purchase price index for raw materials recorded 59.1%, remaining above the critical value for the 13th consecutive month, indicating that amid insufficient log supply in many countries, it was still difficult to alleviate cost pressure from raw materials. Data also showed that the purchase prices of raw materials increased in most pilot countries. In addition, enterprises faced cost pressure from labor, logistics, electricity, taxes, among others, and were hoping for government tax reductions or subsidies to help ease these burdens.

Main updates related to the wood-based panel market include: monitoring data from the Industrial Development Planning Institute of China’s National Forestry and Grassland Administration showed that in the first half of 2025, China’s plywood industry saw a decline in the number of enterprises but an increase in total production capacity; its fiberboard industry experienced a decrease in the number of enterprises and a continued contraction in the total production capacity; and the particleboard industry saw a slight decline in the number of enterprises and a slowdown in the capacity growth. In June, Brazilian tropical plywood exports increased 3.0% in volume, from 2,900 m3 to 3,000 m3, but declined 11.0% in value, from US$1.9 million to US$1.7 million.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|