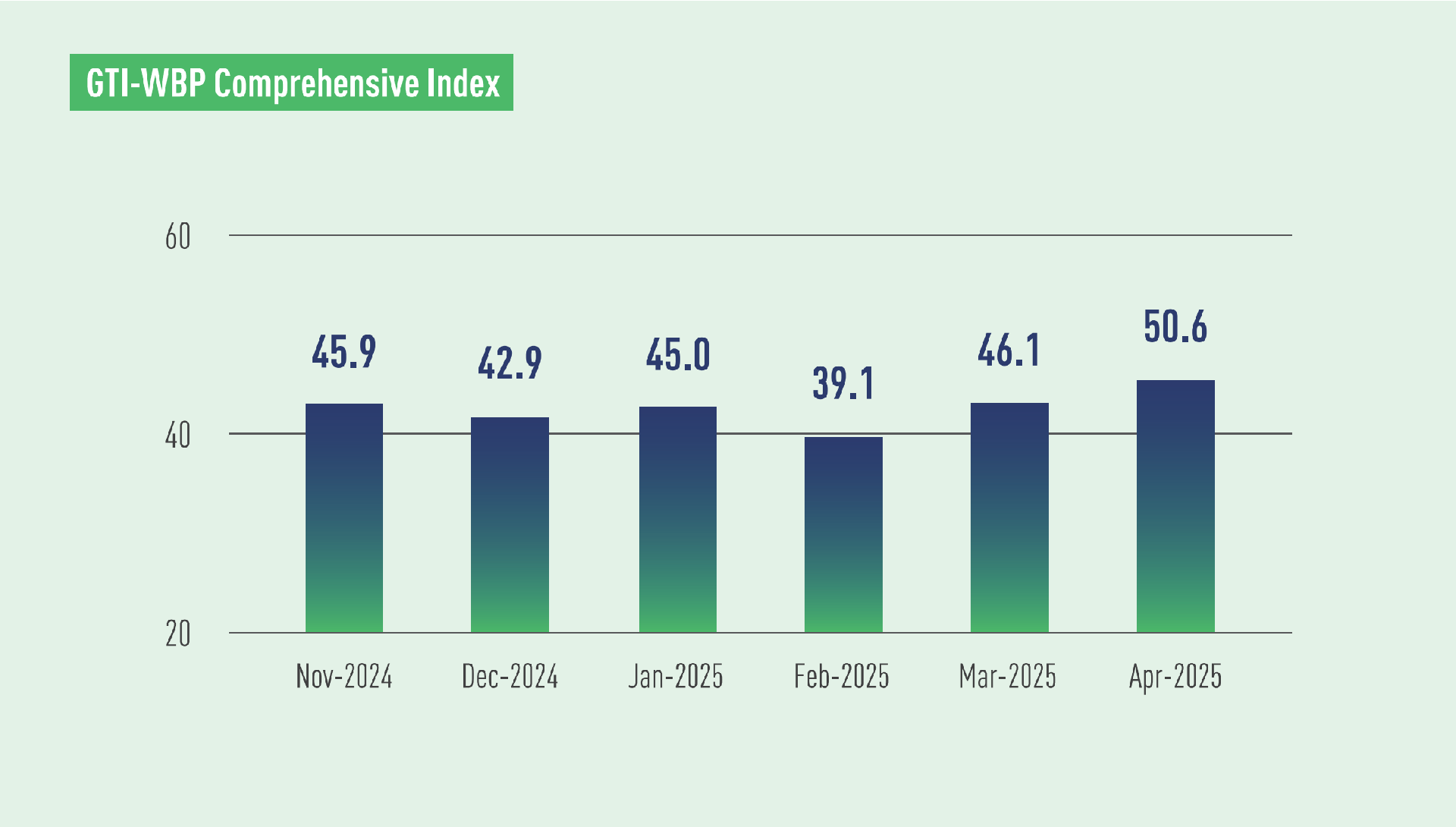

In April 2025, the GTI-Woodbased Panel (GTI-WBP) Index registered 50.6%, an increase of 4.5 percentage points from the previous month, the first time in a year that it rose above the critical value (50%), indicating that in the GTI pilot countries, the overall business prosperity of wood-based panel industry represented by the index expanded from the previous month.

On the demand side, the overall demand for wood-based panels in the GTI-WBP pilot countries showed an upward trend. This month, the new orders index rose by 12.6 percentage points to 54.3%, and the export orders index increased by 19.5 percentage points to 51.2%, indicating a recovery in overall market demand for wood-based panels, and also signaling increased business activities in both domestic and international markets. However, there were differences in performance across product categories and regional markets. For example, some GTI-Malaysia sample enterprises reported a decrease in plywood demand for export.

On the supply side, the supply of wood-based panels in the pilot countries showed an upward trend for the second consecutive month, with the production index reaching 50.9%. This month, production activities for wood-based panels in countries such as China, Mexico, and Ghana had fully resumed, and signs of recovery on the supply side were becoming evident. However, according to feedback from sample enterprises in the pilot countries, many enterprises were facing challenges such as insufficient supply of raw materials, unstable quality of materials, and rising production costs. In response, the enterprises hoped to reduce costs, find better timber sources, and expect greater government support to help ease the pressures on production and operations.

In terms of prices, the purchase price index for raw materials recorded 59.2%, remaining above the critical value for ten consecutive months, indicating that the costs of raw materials continued to rise. This month, raw material purchase prices increased in Ghana, Brazil, Mexico, and China, with Ghana experiencing the most significant increase. Sample enterprises in Ghana reported high prices for raw materials and spare parts needed for production, compounded by high taxes at the port for imported raw materials and spare parts, as well as high borrowing costs. These challenges had created significant cash flow pressure for enterprises, who were hoping to get financial support such as government subsidies and soft loans from banks.

Main updates related to the wood-based panel market include: Chairwoman of the Plywood, Panel Board, and Wood Materials Industry Group at the Federation of Thai Industries (FTI) stated that Thailand's medium-density fiberboard (MDF) and particleboard products are considered high-potential goods for export, produced from domestic raw materials such as rubberwood and eucalyptus; Mexico’s imports of particleboard increased by 13.7% in 2024, reaching a total value of US$120.03 million, and the United States was still a major source, however, imports from the country slightly dropped 3.8% to US$41.98 million; and in Gabon, according to data published by the Directorate General of Economy and Fiscal Policy, plywood production activities in the country fell by 24.3% in the fourth quarter of 2024 compared to the previous quarter, due to shortages of electricity and logs.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|