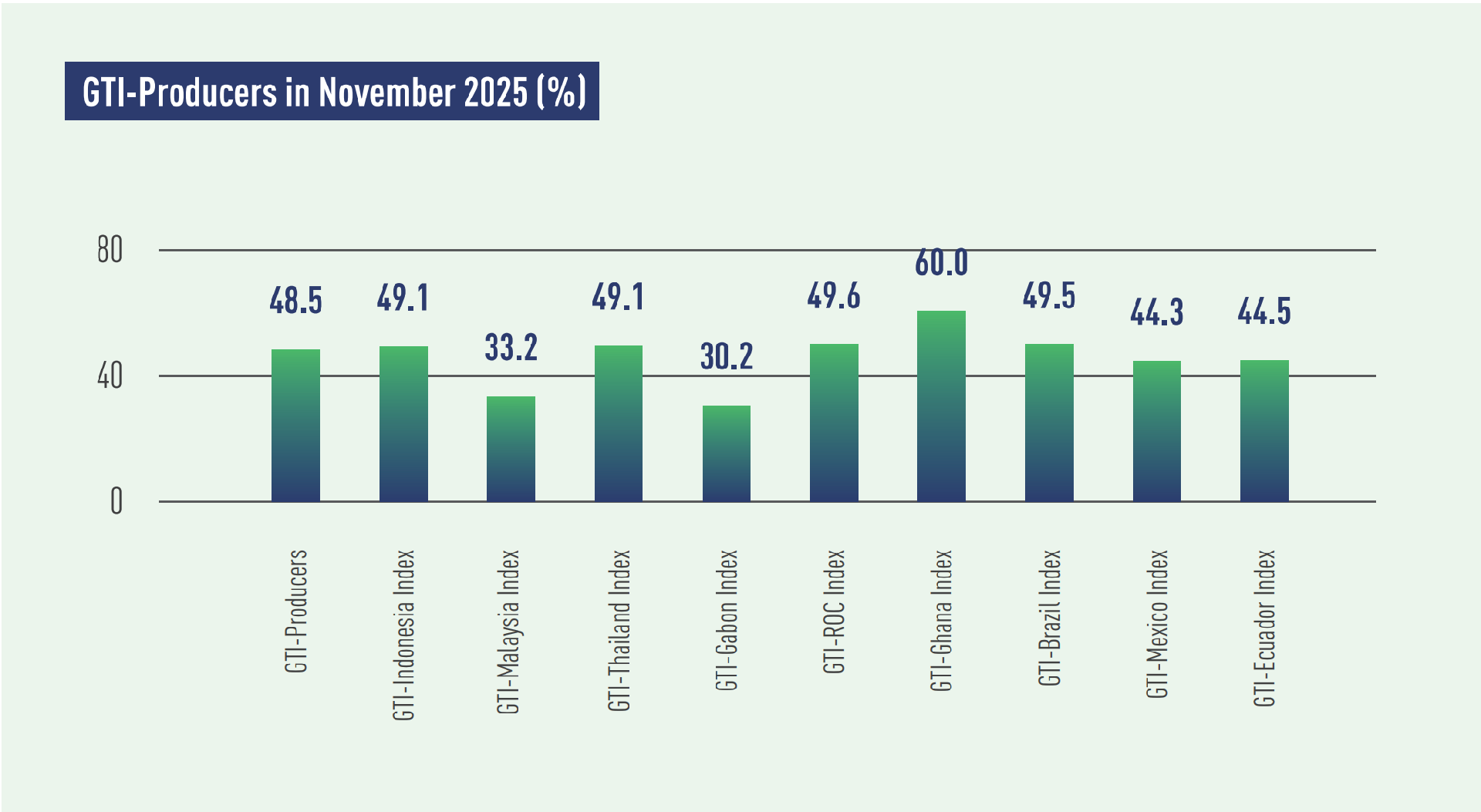

In November 2025, the GTI-Producers registered 48.5% and stayed below the critical value (50%) for several consecutive months, indicating a continued downturn for the timber harvesting and primary processing industries in the pilot producing countries.

In Asia, the GTI readings for Indonesia, Thailand, and Malaysia were 49.1%, 49.1%, and 33.2%, respectively—all below the 50% threshold and within contraction territory. On the supply side, Indonesia’s production volume declined for the third consecutive month, and after several months of growth, harvesting volume also fell. In Thailand, harvesting volume dropped for the second consecutive month, but production stabilized. And in Malaysia, its timber sector continued to see declines in both harvesting and production. This month, enterprises in all the three Asian countries reported raw material supply shortages. Severe flooding in parts of Thailand and Malaysia affected harvesting activities to some extent, while Indonesian sampled enterprises reported shortages of red meranti in particular and noted that heavy rainfall slowed log transport. On the demand side, Indonesia saw an increase in both domestic and overseas orders. Thailand’s timber export market contracted, but overall new order volume remained largely stable, supported by growth in domestic demand. For Malaysia, however, both domestic and overseas demand remained weak.

In Africa, the GTI readings for Ghana, the Republic of the Congo, and Gabon were 60.0%, 49.6%, and 30.2%, respectively. Ghana’s timber sector continued to expand, while the other two countries remained in contraction territory. Supply-side performance varied significantly across the three. Ghana saw notable growth in both harvesting and production compared to the previous month. Gabon experienced a continued decline in harvesting volume, while production—after holding steady for two months—also fell. In the Republic of the Congo, both harvesting and production volumes remained unchanged from the previous month. On the demand side, Ghana saw a slight decline in the volume of new orders due to contraction in export markets. Gabon recorded significant contraction in both domestic and overseas markets, with enterprises reporting falling demand in Asian markets. Markets of the Republic of the Congo remained largely stable, both domestically and for exports.

In Latin America, Brazil, Ecuador, and Mexico posted GTI readings of 49.5%, 44.5%, and 44.3%, respectively—both below the 50% threshold—reflecting a mild contraction in timber sector performance. On the supply side, Brazil maintained growth in both harvesting and production for the second consecutive month. In contrast, Ecuador saw both harvesting and production volumes decline for two consecutive months. Mexico began to enter its dry season, easing the previous downward trend in harvesting, while production remained stable compared to the previous month. On the demand side, despite continued tariff pressures, export markets showed positive signals in the three countries. Supported by overseas markets, sampled enterprises in Brazil saw a slight increase in total new orders. Ecuador’s export market stabilized after previous declines, and boosted by domestic demand, its total new orders increased significantly compared to the previous month. In Mexico, total new orders declined, but the export market also stabilized after previous contractions.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|