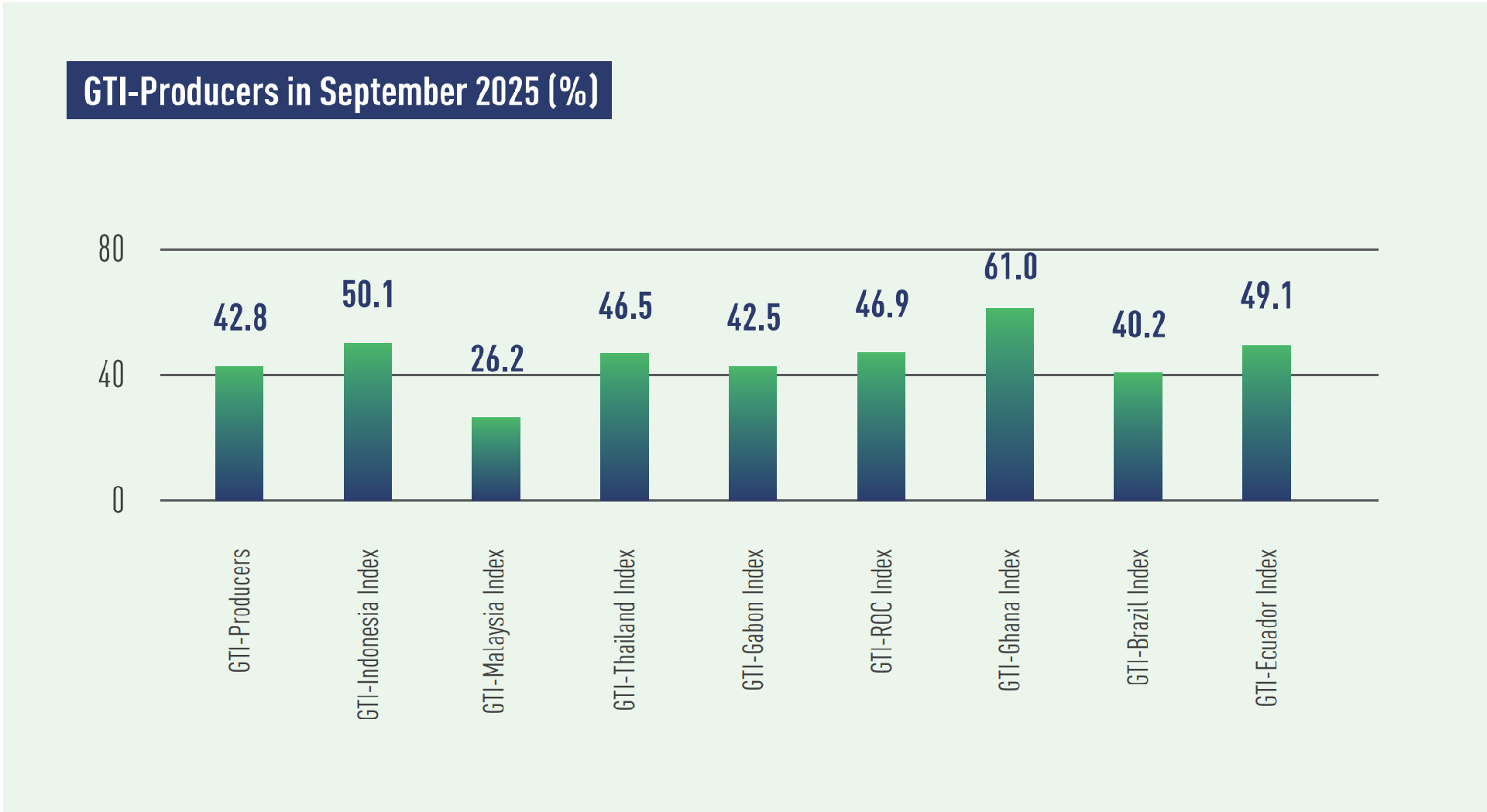

In September 2025, the GTI-Producers registered 42.8% and stayed below the critical value (50%) for several consecutive months, indicating a continued downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Among the countries, Ghana’s timber sector remained in expansion territory, and Indonesia's sector held steady. In contrast, the timber sector in Gabon fell back into contraction territory, and the readings for other countries were still in contraction territory.

In Asia, the GTIs for Indonesia, Thailand, and Malaysia stood at 50.1%, 46.5%, and 26.2%, respectively. On the supply side, the total volume of harvesting increased in the region. Breakdowns revealed that both Indonesia and Malaysia saw an increase in harvesting, and Thailand's volume stabilized after three consecutive months of growth. Nevertheless, the inventory of main raw materials in both Malaysia and Thailand had been declining for several consecutive months. Data also showed that production volume in all the three countries fell compared with the previous month, with Malaysia experiencing the sharpest decline. On the demand side, new orders increased in both Indonesia and Thailand, though Indonesia’s growth was entirely driven by the domestic market, while Thailand’s order growth was mainly supported by exports. In contrast, Malaysia’s domestic and overseas markets remained sluggish.

In Africa, the GTIs for Ghana, the Republic of the Congo, and Gabon were at 61.0%, 46.9%, and 42.5%, respectively. Ghana's timber sector remained in expansion territory for the ninth consecutive month, Gabon saw a decline after the recovery observed in the previous month, and the Congo saw a moderation in its downward trend. On the supply side, Ghana's timber harvesting and production volumes increased, continuing the growth seen in the past several months; in Gabon, harvesting volume shifted from growth to decline, while production volume held steady compared to the previous month; and in the Republic of the Congo, its harvesting activity stabilized after previous declines, and a smaller decline was seen in production. Regarding raw material prices over the past six months, prices in Gabon were generally stable, fell in the Republic of the Congo, and maintained an upward trend in Ghana. On the demand side, Ghana’s volume of orders continued to grow, whereas both the Congo and Gabon saw contraction in their domestic and international markets.

In Latin America, the GTIs for Ecuador and Brazil recorded 49.1% and 40.2%, respectively, both below the critical value. This month, Ecuador’s harvesting and production volumes rose slightly compared to the previous month. However, according to feedback from GTI-Ecuador sample enterprises, challenges such as rising fuel prices and slow administrative procedures had constrained supply-side activities of local timber sector. In Brazil, harvesting volume, production output, and inventory of raw materials continued to decline, however, all the contractions had eased. On the demand side, both countries’ export markets shrank due to factors such as international market fluctuations and trade policies, while their domestic markets were nearly stable.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|