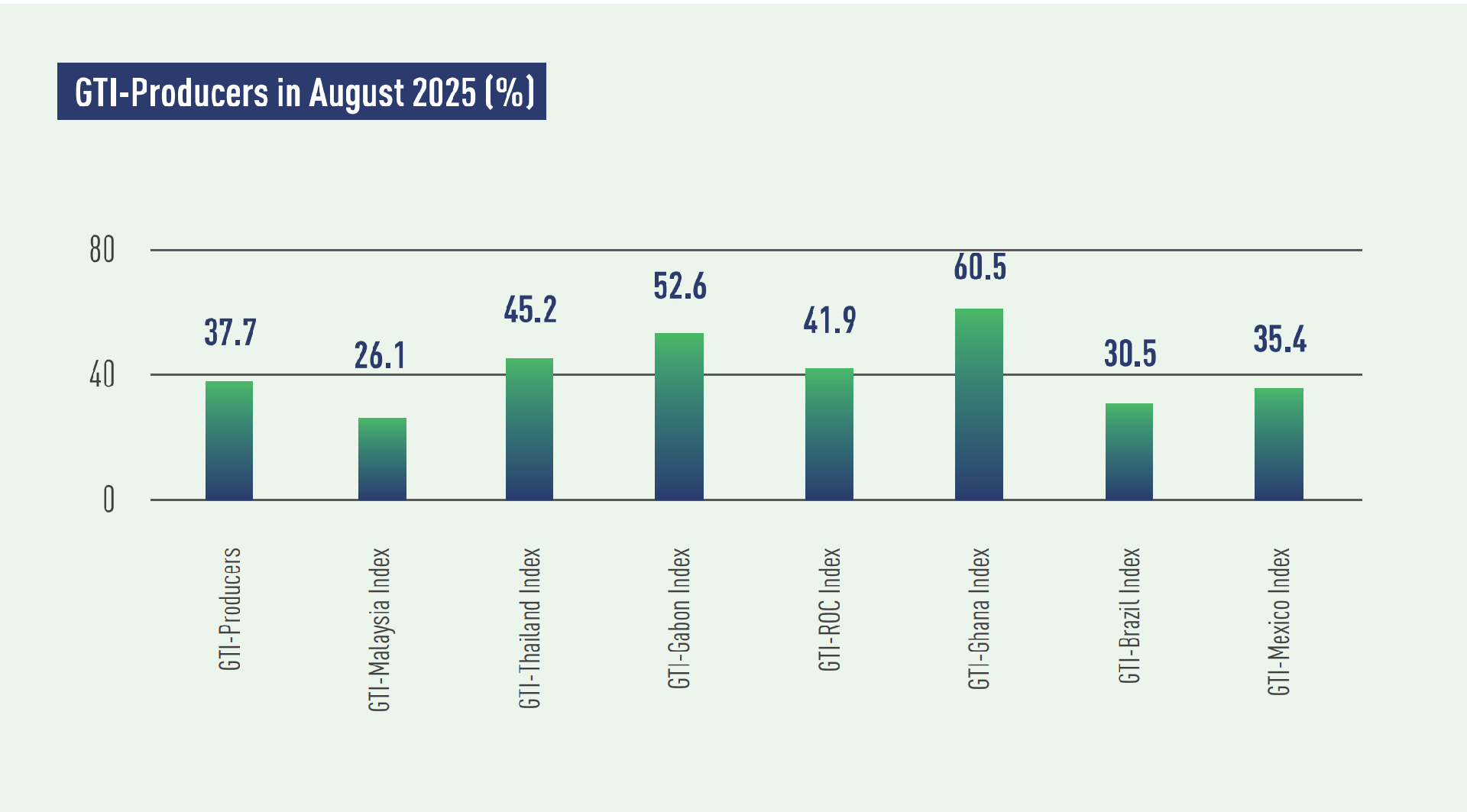

In August 2025, the GTI-Producers registered 37.7% and stayed below the critical value (50%) for several consecutive months, indicating a downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Among the countries, Ghana remained in expansion territory for the eighth consecutive month and Gabon's timber sector showed signs of recovery after a long period of slowdown. In contrast, timber sectors in Thailand and Brazil fell back into contraction territory, and the GTI readings for other countries were still in contraction territory.

In Asia, the GTIs for Thailand and Malaysia stood at 45.2% and 26.1%, respectively. On the supply side, Malaysia continued to see a decline in both harvesting and production. Additionally, the inventory of main raw materials had experienced significant decline for several consecutive months. Malaysian Plantation and Commodities Minister said that the country would continue to prohibit the export of raw logs, with local timber reserved exclusively for domestic processing. However, the government is open to timber imports to support local demand and ease pressure on natural forests. In Thailand, the volume of harvesting had increased for the third consecutive month, while production volume showed decline. On the demand side, Thailand’s domestic new orders decreased, while its export market continued to show an upward trend. Meanwhile, in Malaysia, both domestic and international markets remained relatively sluggish.

In Africa, the timber sector showed overall improvement this month. The GTIs for Ghana, Gabon, and the Republic of the Congo were at 60.5%, 52.6%, and 41.9%, respectively. Ghana's timber sector continued its upward trend observed in recent months, and Gabon's industry showed signs of recovery after a long period of slowdown. The Congo, however, remained in contraction territory. On the production side, Ghana posted continued increases in both harvesting and production. Gabon saw a recovery in supply, with the volumes of harvesting and production increasing significantly compared to the previous month. In contrast, the Congo experienced a contraction in harvesting and production. Demand-side performance also varied: Ghana sustained growth in new orders, Gabon’s expansion was driven largely by robust foreign demand—a highlight this month, while the Congo continued to face mild contraction in both domestic and international markets.

In Latin America, the GTIs for Mexico and Brazil recorded 35.4% and 30.5%, respectively, both below the critical value. On the supply side, both countries saw a significant decline in harvesting and production. Mexico’s supply chain was particularly affected by the rainy season, shifting from expansion to contraction since June. On the demand side, market performance was sluggish in both countries, particularly with exports declining significantly, when the U.S. tariff policies had a noticeable impact on the Latin American timber industry. Also, some GTI- Brazil sample enterprises reported reduced business due to U.S. tariffs and anti-dumping measures in Europe.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|