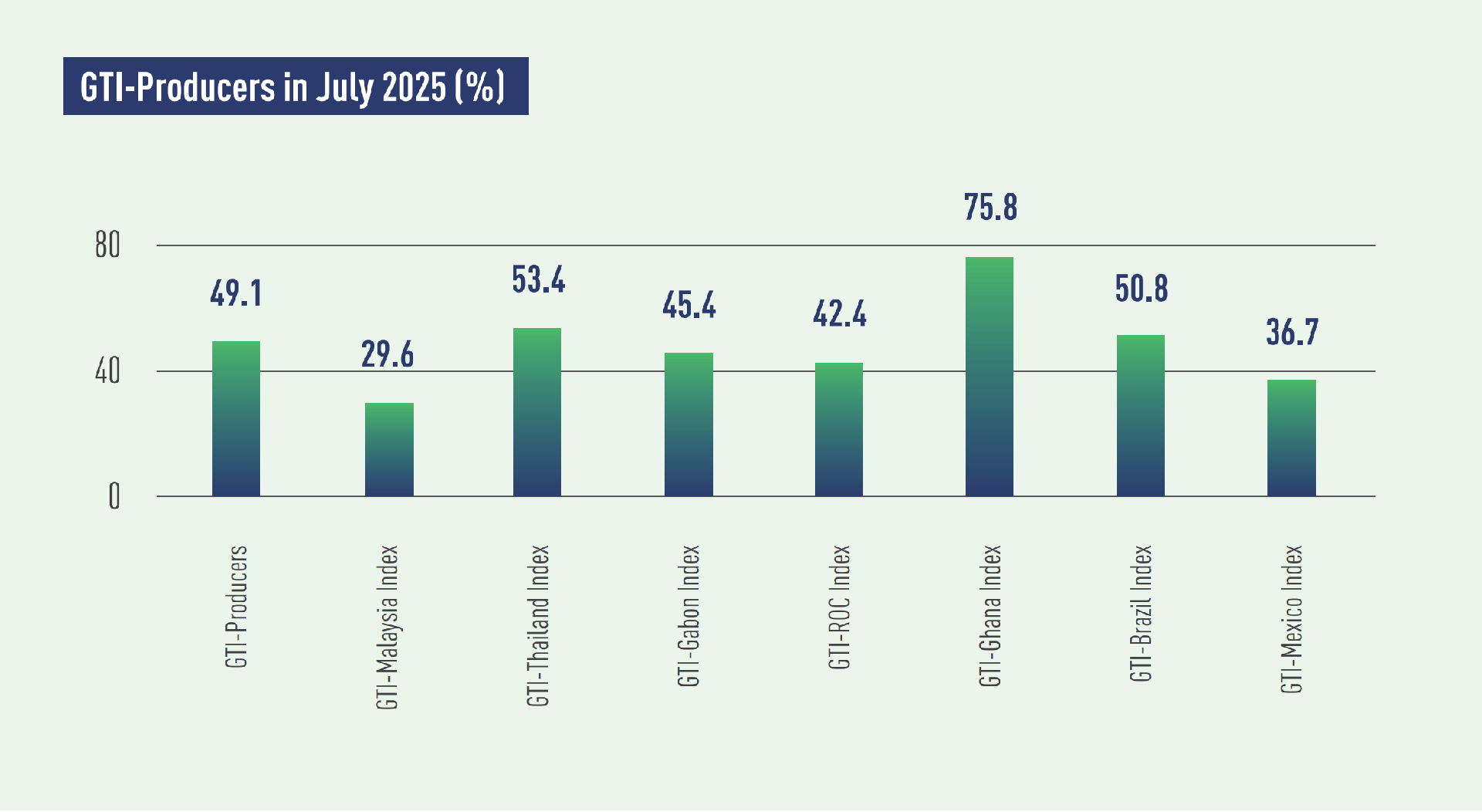

In July 2025, the GTI-Producers registered 49.1% and stayed below the critical value (50%) for several consecutive months, indicating a downturn for the overall prosperity of the timber harvesting and primary processing industries in the pilot producing countries. Among the countries, Brazil's timber sector showed signs of recovery, Ghana and Thailand continued their upward trend, while the GTI comprehensive indexes for other countries were still in contraction territory.

In Asia, the GTI for Thailand registered 53.4%, marking the second consecutive month in positive territory, while the GTI for Malaysia was at 29.6%, still below the critical value. On the supply side, sample enterprises in both countries reported insufficient raw material supply. In Malaysia, both harvesting and production volumes continued to decline this month. In Thailand, despite disruptions from heavy rains and other factors, its harvesting volume rose for the second consecutive month, and production volume maintained upward trend from the previous month. However, its inventory of main raw materials was still shrinking, also representing a slide that had persisted for several months. On the demand side, Malaysia’s market demand remained weak, though the contraction had eased. Thailand’s export market continued to show robust growth, but domestic demand contracted, partly due to weakness in the real estate sector.

In Africa, the GTIs for Ghana, Gabon, and the Republic of the Congo (ROC) stood at 75.8%, 45.4%, and 42.4% respectively. Ghana’s timber sector had remained in expansion territory for seven consecutive months, while ROC and Gabon remained in contraction. On the supply side, Ghana’s harvesting and production continued to show significant growth. However, GTI sample enterprises in the country reported high costs for raw materials (e.g., logs and adhesives), while GTI data also showed that the purchase prices of Ghana’s main raw materials had been rising for several consecutive months, indicating mounting cost pressures for timber producers in the country. In Gabon and ROC, the harvesting volume turned from growth to a downward trend this month, and historical data for the past six months suggests harvesting activities remained predominantly contractionary in both countries. Besides, production volumes in both countries also fell this month. On the demand side, the volume of new orders for Ghana continued to increase steadily, while for enterprises in Gabon and ROC, the market was still shrinking.

In Latin America, the GTIs for Brazil and Mexico recorded 50.8% and 36.7%, respectively. Brazil returned to the expansion territory after staying in the doldrums for six months, while Mexico remained in contraction territory for the second consecutive month. This month, Brazil’s harvesting volume fell sharply from the previous month, and production volume also declined. Since October last year, supply side in Brazil had remained relatively weak. In Mexico, harvesting volume decreased slightly after four months of growth, and production declined for the second consecutive month. On the demand side, trends differed: Brazil’s timber sector saw an overall increase in new orders this month, mainly driven by a significant recovery in domestic demand, while Mexico’s export market held steady but its domestic market was weak.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|