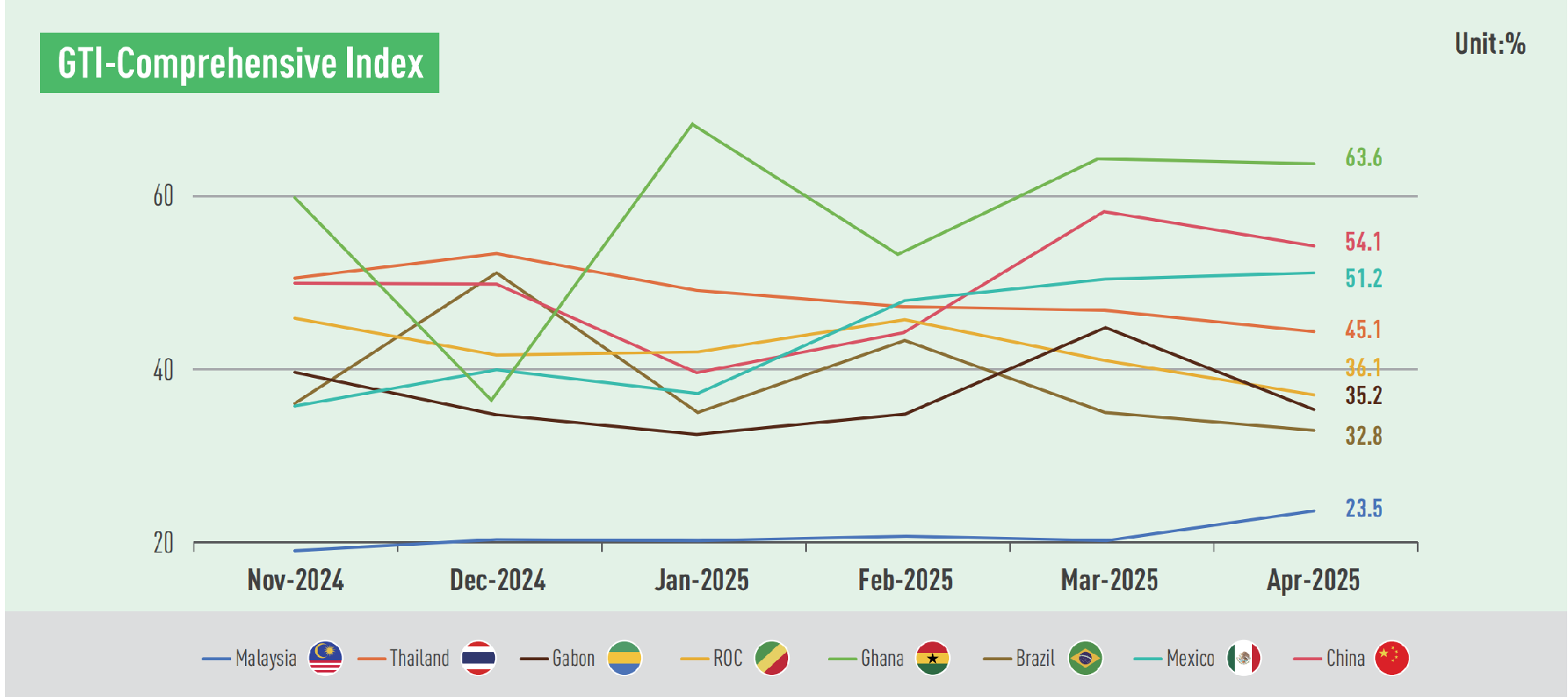

The Global Timber Index (GTI) Report for April 2025 revealed that the overall performance of the global timber market improved slightly this month. The GTIs for Ghana (63.6%), China (54.1%), and Mexico (51.2%) were above the critical value of 50%, and all remained in the expansion territory for two consecutive months, thus indicating sustained growth in their timber sectors. The GTIs for Thailand (45.1%), the Republic of the Congo (36.1%), Gabon (35.2%), Brazil (32.8%), and Malaysia (23.5%) were below the critical value in April, indicating an overall decline in their timber sectors.

Positive signs were evident in some of the GTI sub-indices. For example, production volume in Ghana and China continued to rise; Mexico saw a significant increase in domestic orders; the Republic of the Congo’s export market stabilized after a period of contraction; and the decline in harvesting activities eased in both Malaysia and Brazil.

In the field of sustainable forest management, on April 16, the United Nations General Assembly adopted the resolution "United Nations Decade for Afforestation and Reforestation in line with Sustainable Forest Management (2027-2036)". The adoption, which is based on recommendations from the first International Conference on Afforestation and Reforestation held in Brazzaville of the Republic of the Congo last July, aims to promote the restoration of forest ecosystems. In addition, Malaysia’s Sabah State Legislative Assembly had passed the Forest Enactment (Amendment) Bill 2025, which introduces stiffer penalties for forest-related offences. In Thailand, the government is actively addressing issues related to the European Union Deforestation Regulation (EUDR). On April 9, a meeting of National Committee on EUDR discussed guidelines and mechanisms for the effective operations of the committee, aiming to integrate agencies and stakeholders along the entire supply chain, thus enabling production and export to the European Union in compliance with the EUDR.

Recently, the United States imposed additional tariffs on products from many countries, sparking widespread concern in the world. Although the 24% tariff on imports from Malaysia is lower than that of some other ASEAN countries, it still poses significant pressure on Malaysian furniture industry, especially in Muar. In Thailand, the GTI sampled enterprises reported that the US tariff policy and the delay in negotiations between the Thai government and the US had led to a halt in purchases. For Brazil, the United States announced a 10% tariff on imports from the country, and the moderate tariff removes the country from the list of main US targets. However, GTI-Brazil enterprises reported that following the US imposition of tariffs globally, relevant parties were awaiting further developments before making decisions. In addition, on April 14, Brazil's Economic Reciprocity Law officially came into effect. The legislation allows the government to adopt countermeasures against countries and economic blocs that impose unilateral trade barriers on Brazilian products. In China, some enterprises reported a shortage of North America wood, and according to news from a press conference held by the China Council for the Promotion of International Trade (CCPIT) on April 28, a recent survey conducted by the CCPIT among over 1,100 foreign trade enterprises nationwide revealed that the frequent changes in US tariff policies had significantly increased uncertainty. As a result, nearly 50% of the enterprises indicated that they would reduce their business with the US. Meanwhile, 75.3% of the enterprises planned to expand into emerging markets to compensate for the decreased exports to the US.

| E-mail:ggsc@itto-ggsc.org | Tel:86-10-62888626 |

Sigh Up for Emails |

|